On Russia’s “Black Tuesday” yesterday (16 December), the Central Bank tried to stop the ruble’s value falling by hiking interest rates. It didn’t work. The bankers and corporations panicked; the ruble kept falling. It has now lost half its value in six months. The main cause is the falling price of oil, on which the Russian economy is heavily dependent.

Now Russian people are likely to pay the price, with inflation, unemployment and falling living standards. More than at any time since president Vladimir Putin became the Moscow elite’s dominant figure 15 years ago, he is likely to face a population troubled by serious economic hardship.

Putin’s government has shown that, to deal with social unrest, it is prepared to use tools ranging from

“Doctors good – government bad”. Socialists on the Moscow demonstration against health service cuts last month. Photo: www,openleft.ru

beatings and jailings (used against the Bolotnaya anti-government marches in Moscow in 2012) to incitement of military conflict that wrecks cities and divides communities (used in response to the protests and overthrow of government in Ukraine).

Here are some points that might contribute to an analysis.

Q. What are the underlying causes of Russia’s economic problem?

A. Russia has become a subordinate player in the world economy, relying overwhelmingly on the export of oil, gas and metals. During the oil boom of 2002-08, numerous plans to diversify the economy away from these export commodities were drawn up, but none were successfully implemented. So Russia emerged from the boom more dependent on these exports than ever. In 2012, the energy sector (oil, gas, coal and power) accounted for 69% of the money that Russia earned from exports, and contributed 50% of the state’s budget revenues.[1]

As long as oil prices were high, the failure of Russia’s elite to deal with this dependence could be ignored. Their wealth was rising, and, while the gap between rich and poor grew wider than ever, the average living standard of ordinary Russians also rose.

Then came the 2008 financial and economic crisis. It drove oil prices down – but only during 2009. Then they soared to new heights. While Russian manufacturing industry suffered from the recession, oil revenues rose once again. In 2009, Russia suffered a recession – the gross domestic product (GDP), a measure of the size of the economy, fell by nearly 8% – but in 2010-12 Russia registered growth of between 3% and 5%. The economists reckoned that a big part was played by oil revenues, and by two big state projects: the Sochi Olympics, which cost $50 billion, and the Nord Stream gas pipeline to Germany.

In 2013, with those projects finished, economic growth was a measly 1.3%. Industrial production growth was negative (minus 11%) in 2009; it grew by 7% in 2010, but by 2013 was growing by less than 1%. Electricity consumption, a good indicator of economic activity, was 1% lower in 2013 than in 2012.[2]

So Russia’s economy was staggering along miserably BEFORE the annexation of Crimea, the western sanctions and the fall in oil prices.

Q. How much difference have the sanctions made?

A. Some difference, although not as much as the Kremlin’s spin doctors would have you believe. The sanctions were crafted to limit the impact on Russia’s trade with Europe. For example the Russian gas sector, which many European countries rely on heavily, was excluded. The sanctions’ most serious impact has been on large Russian companies that usually borrow funds on the international market. Western banks have stopped lending not only to companies that are actually sanctioned, but to others that might be in future.

During the oil boom, Russia built up its foreign exchange reserves (money held by the state in dollar accounts abroad, including accounts designed to protect the oil money, the Sovereign Wealth Fund and the Fund for National Well-Being). By the end of last year the reserves totalled more than $500 billion. Since sanctions were imposed, the government and Central Bank have dipped into these funds to finance state-owned banks that are sanctioned.

Q. So what were the triggers for this week’s collapse of the ruble?

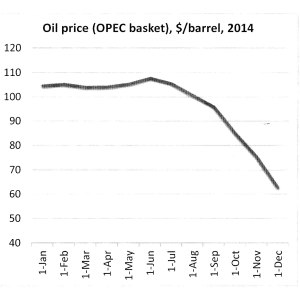

A. Low oil prices, which always threatened to undermine the Putin set-up, have arrived. The OPEC basket price (an indicator that aggregates all the main types of crude oil), which wavered between $100/barrel and $110/barrel earlier this year, fell to about $63/barrel at the beginning of this month, and below $60/barrel this week. On 26 November the OPEC countries met, and surprised many people

by deciding not to limit production in order to support prices. Now energy economists and market analysts are saying that, judging by supply and demand dynamics, oil prices will stay low for much of next year.

The ruble’s value has been falling in line with oil prices. The OPEC announcement didn’t help. Some Russian economists think that another turning point came last week when Rosneft, the largest state-owned oil company, issued corporate bonds worth 625 billion rubles (about $10 billion at last week’s prices). Rumours swirled around the financial markets that these bonds were bought by state banks – and certainly no-one else would have rushed to buy them, since the coupon paid on them (the interest earned by the lender) was 11-12%, compared to a market rate of 13%. This meant that the state was printing money to support Rosneft. The bankers feared Rosneft was using the cash to buy dollars to repay debts to foreign banks (a charge Rosneft denied), i.e. further weakening the ruble.

There is a history to this. Rosneft’s chairman is Igor Sechin, a former security services officer, close colleague of Putin and often considered to be the second most powerful man in Russia. In the mid 2000s, Rosneft bought up most of the production assets of Yukos, the oil company once headed by Mikhail Khodorkovsky, the oligarch jailed after falling out with Putin.

Rosneft is seen as the flagship of Putin’s state capitalism, and economic liberals in or around Putin’s entourage don’t approve of its methods. Aleksei Kudrin, who came to Moscow from St Petersburg at the same time as Putin in 1999, and was one of his closest collaborators until quitting as finance minister in 2011, tweeted on Monday that the market “reacted negatively” to the “opaque” Rosneft bond deal. Sechin, who usually keeps his cool, exploded to journalists that it is necessary to “deal with interested parties and provocateurs”.

Who knows whether the rumour that the government was printing money to support its favoured companies made things worse? (Sergei Guriev, a former economic adviser to Putin now effectively in exile, thinks it did. See here.) In any case, on Monday the ruble fell at an accelerated rate, and at 1.0 on Tuesday morning (i.e. before the markets reopened in Russia’s Far East) the Central Bank acted, raising its interest rate from 10.5% to 17%. But that aggravated things, triggering panic among currency traders and exposing the ruble’s underlying weakness. The Central Bank was strongly criticised by financiers for standing by all day Tuesday as the situation worsened.

The currency slid hour by hour and middle-class Russians crowded shops, buying anything from TVs to washing machines that would keep its value more reliably. Analysts suggested that the government’s next step could be capital controls, although the authorities denied that. On Wednesday lunchtime, the Central Bank official exchange rate was 67.79 r. to the dollar, compared to around 34 r. in mid June.

Q. How will this affect ordinary Russians?

A. The steep devaluation and high interest rates will have serious consequences. The several years of economic recession that Russian economists are forecasting will take a heavy toll on ordinary people. Companies with dollar-denominated loans will go bust; all companies will find it tough to borrow; there will be bankruptcies and lay-offs. Among ordinary people, those with ruble savings can take some comfort from the higher interest rate, but those living on credit – and there are millions – will bear a heavy burden. The soaring price of imports will put many consumer goods back out of ordinary people’s reach. Inflation will cut the value of wages.

One of the most surprising statistics in the World Bank’s Russian Economic Report is its estimate of the dollar value of average wages in Russia. This has risen remarkably, from $588/month in 2009 to $806/month in 2011 and $942/month in 2013, in large part due to rising public sector wages paid from the state budget. This is an average figure, of course, and does not reflect the terrible poverty e.g. in industrial towns where the main plant has closed, in the countryside, or in poor regions such as the Caucasus. But in any case it seems inconceivable that the average wage, counted in dollars, will keep going up. On the contrary, working-class households will be the main victims of ruble inflation.

Q. How might social and labour movements react to this?

A. Falling living standards do not automatically trigger social struggles. Rather than trying to guess what will happen, it makes more sense to look at the patterns of social and labour protests, not only in Russia but across the former Soviet space, since the 2008-09 economic crisis. In 2011 the largest strike struggle of recent years, by Kazakh oil workers, culminated in a wave of repression and the police massacre of protestors at Zhanaozen. (See here.) In that same year, even the dictatorial regime in Belarus faced protests over the conduct of elections, and at the end of 2011 and the first half of 2012 there were huge demonstrations in Russia on similar issues.

It can not be said that most working-class Russians associated with this movement. Probably the largest social force involved was the middle class of Moscow and St Petersburg. But the government was rightly terrified. Arrests, and heavy jail sentences for leftists, followed. (See here.) In my view, the protests that began on Independence Square (Maidan Nezalezhnosti) in Kyiv in November 2013 is best understood as an indirect continuation of the protests in Moscow and Minsk. The demonstrators united around fairly vague aspirations for democracy and justice, and against government corruption. In Kyiv’s case the western media focused on the demand for integration into Europe, but there is plenty of evidence that this was not the principal issue for many demonstrators. (It’s complex and I’ve written about it e.g. here.)

The Kyiv protests mushroomed into a nationwide movement in which a range of political forces participated, and led to violent confrontation with the state forces brought in to repress it. As separatism raised its destructive, divisive head in eastern Ukraine, an “anti Maidan” movement emerged with politics as confused as those of “Maidan”. But the point here is that the Kremlin, which views most of the former Soviet states as its sphere of influence, became extremely alarmed. This triggered the annexation of Crimea and the Russian support for armed separatism in south eastern Ukraine (via diplomacy, an open border for volunteer militia and large amounts of weaponry, and – most likely, despite government denials – some level of Russian army involvement).

In my view, THIS is the link between the Ukrainian events and Russia’s own economic crisis. Any meaningful analysis has to start with a recognition that the Kremlin’s actions, including the way that it has fuelled the military conflict in eastern Ukraine, were taken above all in response to social unrest.

The Russian elite knew very well – from isolated outbursts of labour protest in 2009, from the Moscow marches in 2012, and from myriad other indications – that the spectre of such unrest haunts it in Russia itself. It was this, and not only its support for former Ukrainian president Yanukovich, that triggered its extreme actions in the spring.

As a result of the damaging separatist action, the economy of Donetsk, one of Ukraine’s most important industrial areas, has been wrecked. Coal mines have been flooded and closed while miners join militia on either side of the conflict. (Meanwhile in most of Ukraine, a deteriorating economy is in the charge of a government dominated by oligarchs and beholden to the IMF, which is warning of a $15 billion finance gap to be filled for Kyiv.)

Recent reports from Donetsk (e.g. here, in Russian) indicate that, with miners not having been paid for months, protests are starting, as they did in the 1990s, with demonstrations by women in the mining communities. (See also here.)

If you want to see how Putin’s reactions to the economic crisis may impact working-class communities, focus first on war-torn eastern Ukraine.

In Russia, a new wave of protests erupted in Moscow in November, against planned cuts to the health service. (See a report on the Russian Reader site here.) The point is not that these movements are going to trigger a nirvana of social change, but that they will face a Russian elite whose options have been cut down by the economic crisis, and which has shown in eastern Ukraine the murderous lengths to which it will go.

Q. Should the Russian economic crisis be seen in the context of a “new cold war”?

A. No, not in my view. Certainly the western media is full of commentary by members of the western elites rubbing their hands in glee at the thought of the “Putin system” collapsing. But (i) such a collapse seems unlikely in the short term (although an extended and unabated economic crisis, and/or social movements on a Ukrainian scale, could mean that judgement would have to be revised), and (ii) the western powers are divided on how far to pursue their trade war with Russia. On Tuesday, US president Obama announced new laws providing for further sanctions, but it is clear that the German ruling class, most significantly, does not agree.

In any case a “new cold war” would surely imply that Russia is, or could become, some sort of superpower, comparable to the Soviet Union, able to undertake a prolonged conflict with the west and to create a financial and economic space outside the west’s control. This is obviously not the case, because of Russia’s one-sided economic model and vulnerability to low oil prices, so powerfully demonstrated this week.

The “new cold war” exists mostly in the minds of Kremlin propagandists, US neo-conservatives, and misguided people in the labour movement who are thinking in the geopolitical categories they learned during the old cold war.

Q. What are the wider international consequences of such low oil prices?

A. Russia and other former Soviet states are not alone in facing a possible upsurge of social and labour movements. OPEC’s decision not to act on 26 November, taken mainly at the insistence of Saudi Arabia, leaves other Middle Eastern and North African oil producers (Iran, Iraq, Algeria, Egypt, etc) vulnerable. Low oil prices means that these governments will struggle to fund social concessions (e.g. subsidised energy, health and welfare, pensions, etc) that were stepped up in the wake of the “Arab spring” of 2011-12. Venezuela and Nigeria, as well as Russia, could face similar problems.

Socialists are very fond of imagining that economic crisis will lead automatically to attacks on working-class living standards, which in turn will lead automatically to glorious struggles. The lessons of recent years, whether in Egypt or Ukraine, is that things don’t happen like that. But the economic strains on the elites of oil-producing countries are very real. In Russia and perhaps elsewhere, these economic conditions will certainly trigger social and labour movements that those elites don’t like and can’t control. GL, 17 December 2014.

More to read

Ukraine: war as a means of social control (on People & Nature)

The Russian Reader (a great source of information on social movements in Russia)

[1] Statistics from Rosstat, the state statistics agency. 2012 is the latest year for which information is available.

[2] Statistics from the economic development ministry and World Bank Russia Economic Reports

So you don’t think the oil price was driven down deliberately by the Saudis at ,American behest, to wreck the Russian economy, and those of Iran and Venezuela whilke they were about? You don’t thinlk that is cold-warism? Why else did OPEC decide to keep expanding production at a time demand was falling?

Hi there Timgo. The amount of oil lost due to the industry being disrupted by social struggles and war in Iraq, Libya, Syria etc is, as far as I know, pretty much the same amount as is now being produced from shale in the USA. If the US government really wanted to manage the level of world oil supply, it could give its own shale producers some incentive (e.g. via taxation) to stop producing, couldn’t it? Why get the Saudis to do the dirty work? Second point is that, as far as I understand from people who know more about it than me, the Saudis have basically decided that they are not going to try single-handedly to manage the level of supply. With Iraq, Venezuela, Nigeria and others not inclined to obey OPEC decisions, because they are desperate to keep producing to get the revenue, it always falls back on the Saudis. Apparently they have decided that it’s wiser to let the market do its work (i.e. push the highest cost producers out of business so that supply falls) than do it themselves. And note that the highest cost producers are NOT in Russia. At least some of them, ironically, are in the USA, and some people think that the first oil companies to go bust will be US shale producers. (It’s complicated because for some of these small companies it’s better to go on producing at a loss and paying your bank debt than to go under.) As for the Russian economy, low oil prices reduce revenues, but won’t necessarily drive it out of business. What I tried to say in the piece is that its chronic dependence on oil (a problem since the 1970s) and the 2008-09 crisis have done the damage even before US sanctions were applied. To my mind capitalism is in an economic crisis, and trying to understand the economics makes more sense than putting oil price movements down to manipulation by imperialism. And here’s a historical analogy: in the late 1980s some people in the Soviet apparatus managed to convince themselves that the low oil prices then were the result of a CIA conspiracy to destroy the Soviet Union. The Soviet Union was destroyed, low oil prices certainly helped it on its way … but does anyone now seriously believe that it was due to a CIA conspiracy as described? That gives the CIA too much credit, and the wild workings of crisis-ridden capitalism too little.

Interesting piece Gabriel, although apropos of your penultimate paragraph, Egypt is a net importer these days. Because it is also a heavy subsidiser, this price fall is really good for it, and tends to reduce the prospects of unrest.

I’m not an expert on the geopolitics of oil, but – even leaving the USA outside of the question – it seems pretty plausible, doesn’t it, that Saudi Arabia is maintaining supply/keeping the oil price down in order to punish Iran and Russia over Syria? The USA might be pleased or even encouraging about the strategy, but Saudi is increasingly independent these days. In its foreign policy stop

I’m not sure what you mean by Saudi letting the market do its work? I mean, given that it controls (directly and through OPEC) the supply, there is no level of supply defined by market independently of the Saudis.

Clearly, Saudi has chosen to take a hit in medium and long term revenue by not reducing their own supply to keep world levels constant in the face of the emergence of US shale oil. The question is why they have done this, right? The most popular theory appears to be geopolitical one, to hit out at Iran and Russia.

Why else would it be? Because they need short-term revenue? Seems unlikely. Because they want to compete with US shale oil for US markets? That would seem like a lost cause. Anyway, I’d very much appreciate any suggestions as to what to look for alternative answer, particularly if someone has written something that’s already out there.

hi Tom. If I find an article with an alternative answer, I’ll let you know. I haven’t seen one. I don’t know how the Saudi ruling class takes its decisions, but they must be smart enough to know that a low oil price can do many, many things apart from make life difficult for Russia and Iran – e.g. make life difficult for the elites of many other oil producing countries. I don’t know much about how OPEC takes its decisions either, but one explanation for its inaction on 26 Nov that I’ve heard is that Saudi simply couldn’t get everyone else to come along with it, and decided it wasn’t going to lose market share just to solve everyone else’s problems. I’ve even heard people say we make look back in five years’ time and think of this as the moment that OPEC stopped operating effectively. I’m inclined to listen to such ideas because I have become so accustomed to people exaggerating the importance of geopolitics in oil issues that I tend to look for other explanations first.